TRADITIONAL PROFESSIONAL SPORTS ARE AT RISK OF LOSING A SIGNIFICANT PORTION OF THEIR FUTURE AUDIENCE.

Millions of post-millennials around the world are growing up idolizing eSports champions like Lee “Faker” Sang-hyeok of South Korea and Enrique “xPeke” Martinez of Spain. They’re not rooting for the Vikings or the Packers or the Yankees—they’re rooting for Evil Geniuses and Virtus.pro. For them, the biggest sports upset story in recent memory is not Leicester City FC taking the Premier League title— it’s CDEC Gaming taking $2.8 million at The International 2015 Dota 2 Championship.

The traditional sports industry can’t assume these kids will just come around eventually. eSports has the Cool Factor. It’s truly global in a way that only soccer can rival. Its athletes are drug-tested. And it has a massive head start.

FIFA AND PES | MADDEN | NBA 2K | NHL | MLB THE SHOW | UFC

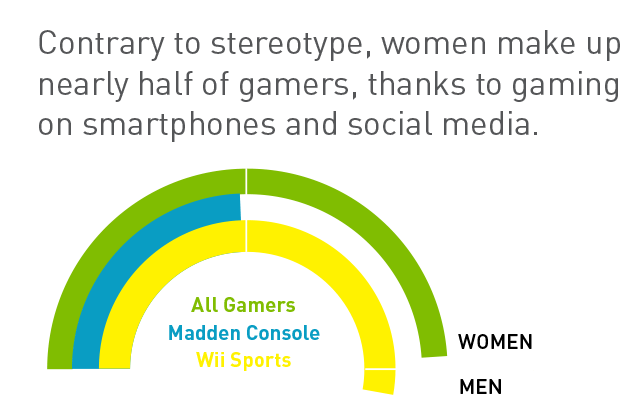

vSPORTS—video game versions of traditional sports— have been proven to create new fans for the stick-and-ball sports they depict. Now the race for the Gen Y and Z fanbases is on, and every sport, league and franchise must step up its vSports game or face long-term irrelevance.nearly half of gamers, thanks to gaming on smartphones and social media.

FEMALE GAMERS

When FIFA added women’s national teams to console play, it took just 16 days for American striker Alex Morgan’s in-game alter ego to score 1 million goals.

GAMERGATE harassment online is keeping female participation down in eSports.

Uninterupted Fifa

The EA FIFA franchise is vSports’ big star thus far. With 2.3 million Interactive World Cup worldwide qualifiers in 2016, FIFA is the largest eSports competition in the world. Nine million games are played every day. And in-game purchasing is fairly evolved, with 2016 sales reaching $650 million. In the first 16 days after its release, 1.5 billion hours of FIFA 16 were played online.

Genuine competition from Pro Evolution Soccer keeps FIFA quality high.

IN-GAME ADVERTISING

Advertising real brands inside eSports fantasy games destroys the narrative. But advertising and sponsorship is part and parcel of sports games; it makes them more legitimate and real.

Advertising inside sports games is expected to spike dramatically.

-

$7B

CURRENT IN-GAME AD MARKET

Global Reach

Sports like volleyball and field hockey, which are among the most popular participatory sports in the world, lack successful video game editions. Madden, the undisputed leader in the USA (4.6M units sold), sells only 11% outside the US. Sales of NBA 2K leapt 28% in Europe when EA added 25 Euroleague basketball teams. NBA 2K is now the 8th most popular video game in China.

LEAGUE OF LEGENDS | COUNTER-STRIKE | DOTA 2 | SMITE | OVERWATCH | STARCRAFT

Betting

Wagering was $315 million in 2015.

Sites like Vulcun, Unikrn and Alpha- Draft have several million eSports fans betting on eSports results and creating eSports fantasy teams.

-

PROJECTED WAGERING ON eSPORTS BY YEAR 2020

$23.5B

eSPORTS FOR ALL SEASONS

There is no such thing as League of Legends 2017—the game just updates automatically, and everyone in the world is playing the same game. vSports’ reliance on up-front sales and annual editions means gamers are segmented. Half the audience for any sport is playing versions that are often two years old or more.

MORTAL CONSOLES

Most eSports are played on PCs, which can be kept current (i.e., today’s hardware). They run on dedicated servers, so the signal quality (“ping”) is not limited by your opponent’s hardware.

vSports are played on consoles that last around five years. Current 8th gen consoles, PS4 and Xbox One, are 2013 hardware, with only occasional firmware updates. Consoles use peer-to-peer technology for players to connect.

Level Playing Field

eSports fans laugh with disgust that vSports games are secretly engineered to make it easier for a losing opponent to catch up late in a game. They don’t consider vSports to be “real” games at all— merely “sports simulations.”

Prize Money

The prize for winning FIFA Interactive 16 was only $20,000. Madden 16 offered $50,000. These were tiny fractions of the prize pool in eSports. Realizing the importance of bigger prize money, NBA 2K 16’s “Road to the Finals” awarded the winners $250,000. Madden Bowl 17 announced a $1 million prize pool, which still would rank only 23rd in the biggest eSports prize pools ever.

We’re never doing sports video games. Never. It’s not what our community wants. We don’t consider sports video games to be true eSports.

Rahul Sood

CEO and cofounder of Unikrn, a leading eSports betting platform

DO Video games create more sports fans?

(Yes, they do.)

Sports franchises shouldn’t worry that vSports titles have become a replacement for watching broadcasts or attending real games in arenas and stadiums. Your future fans are playing the video version right now.

Fifa Players

-

34%were not soccer fans/ had no interest until after playing the video game with friends

-

50%report the video game has made them bigger soccer fans

The Viral Influence

The spectator audience for vSports is not on Twitch live streams, it’s on YouTube. Roughly speaking, every million views earns a YouTube creator around $3,300. Creative millennials have developed huge audiences for their videos where they open player packs, play their favorite vSports game, and make jokes. They have become so famous that pro franchises are opening their doors to these celebrities. Creator networks like Machinima Inc. and Broadband.TV serve to empower and popularize these online celebrities.

Savvy pro teams are taking it a step further, hiring vSports and eSports stars to represent them online:

- German club VFL WOLFSBURG has signed three FIFA pros. 22-year-old Englishman David Bytheway has been playing FIFA professionally since he was 17.

- Sean “Dragonn” Allen now represents WEST HAM UNITED at FIFA tournaments.

- PRO FRANCHISES are crossing the battlefield to have eSports teams wearing their jerseys. Besiktas, Spanish basketball team Saski Baskonia and Valencia have all signed gamers. Schalke 04 has bought a franchise, and Manchester United are rumored to be bidding for Fnatic’s Overwatch team.

The first crossover from real sports to vSports happened earlier this year, when Brazilian pro soccer player Wendell Lira, winner of FIFA’s 2015 goal of the year award (on the field), retired at age 27 to play FIFA (the vSport) professionally.

ARE ALTERING THE POPULARITY OF SPORTS GLOBALLY

FIFA 16 sells 74% of its units outside North America. It sets the bar for others to dream of.

THE NBA 2K franchise is slowly growing its international sales, from 11% in 2013 to 17% today. It’s the 8th most popular video game in China.

UFC is also going global. While its console sales don’t yet challenge the major sports, 40% of the market is outside North America. The smartphone download regularly lives in the top 15 in Brazil and Russia, hitting #1 on big days; in India it’s hit #2. Even in France, where the sport is still illegal, the game’s ranking is on par with its US ranking.

Tennis was once a big player, selling over 2 million copies on console. It has moved to smartphones and lost some sizzle, but is very global—Top Spin sold 65% outside North America. Still, during the weeks of Wimbledon, Ultimate Tennis lives at #1 in India.

MLB The Show at the turn of the millennium was selling 45% of its console units outside North America on Playstation. Today it’s holding at 27%, as Pro Yakyuu Spirits is the big title in Japan.

Madden, the undisputed leader in North America (4.6M units sold), sells only 11% outside the US.

EA NHL 2009 used to have the Russian Super League teams included. The KHL tried to take advantage of the NHL lockout in 2011 with its own video game. Without a unified hockey game, today only 20% of NHL 16 sales are outside North America. Earlier versions, like NHL 2002, sold over half their copies outside North America.

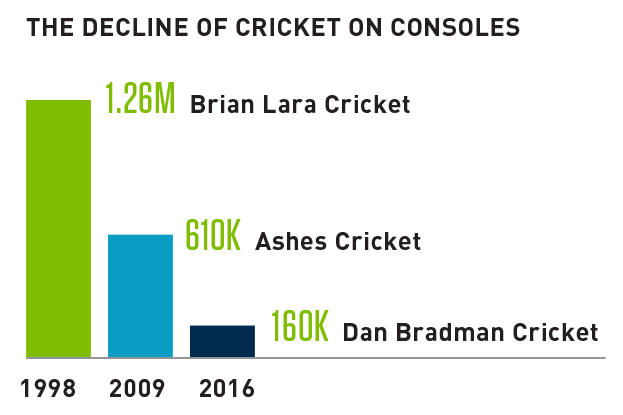

Who’s winning in India? Not cricket, where the market is divided. The best console game has only some licenses, while the licensed game has inferior game play. Console sales for cricket are actually going down.

Cricket in India is all on the phone. Real Cricket 16 and other titles are often in the top 10 in downloads. But 4 of the top 7 phone games in gross revenue are all soccer.

Volleyball was once king; in 1997, it sold almost 2 million copies—just in Japan. But this hugely popular sport has lacked a stellar game for a decade, and even smartphone versions rarely break the top 50.

Handball is breaking out as a big sport all over Europe, and Eko Software’s Handball 16 has modest console sales. Will the sport take off? Not yet, without good games for the smartphone to attract gamers’ interest.

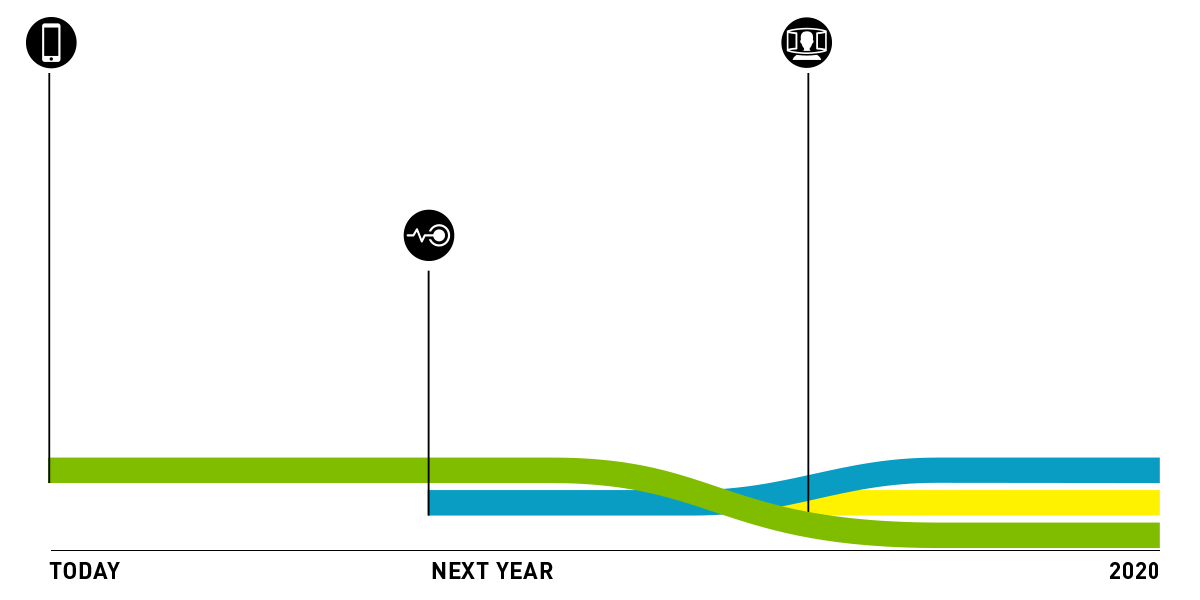

NEW TECHNOLOGIES Will Reboot the Landscape in 2020

eSports took off first in Korea, where “PC Bangs” had superfast internet, allowing gamers to play against each other rather than against the computer. Couples went on dates to the net cafes more than they went to the movies. The social aspect drove popularity.

-

01VR

Virtual reality sports games are easier to imagine than they are to code—challenges such as the headgear tether cable restrict movement, and the causes of motion sickness need to be solved. We are likely still a couple years away from a VR sports game that becomes the killer app that triggers everyone to put down their phone and put on immersive headsets.

-

02Slam Processing

Smartphones, by next year, will have infrared sensors that can sense depth—turning every phone into a Microsoft Kinect. Google’s Project Tango is using this technology to create a virtual map of every room, down to the location of every piece of furniture. The sensors can also track human movement with great accuracy. Before 5G arrives, many games will throw away the thumb controls and have gamers act out motions physically, bringing back something akin to the Wii explosion.

-

035G

Today, smartphone connectivity is on the cusp—you can play against others, but it’s really only a successful experience for minigames. Full sports simulations will explode on the smartphone with 5G connectivity—which is 30x to 100x the speed of 4G. However, trials of 5G have just begun, and 5G phones aren’t expected to be on sale until 2020.

These three factors converge on a 2020 timeline, amounting to a perfect storm that could radically alter which companies survive and which games are played—and ultimately which sports become most popular globally.