- Google, Facebook, or another so-called over-the-top player will outbid all traditional broadcasters for rights to a major global sport — and give the games away for free.

- Athletes will assert control over their off-the-field media presences, carving out a valuable niche of content long held by leagues and broadcasters.

- Advertising revenues from pirated sports content will top $1 billion annually.

- The term “broadcasting” will become obsolete.

-

01

Cord-Cutting: 25% of Late Millennials went completely cable-free in the past year.

-

02

Piracy: More than 50% of Americans between the ages of 18 and 34 admitted to watching pirated content in a recent survey.

-

03

Video streaming has overtaken live programming as the viewing method of choice in American households, 55% to 45%.

-

04

Facebook can integrate your online friends with your viewing experience, something that mainstream broadcasters can’t do.

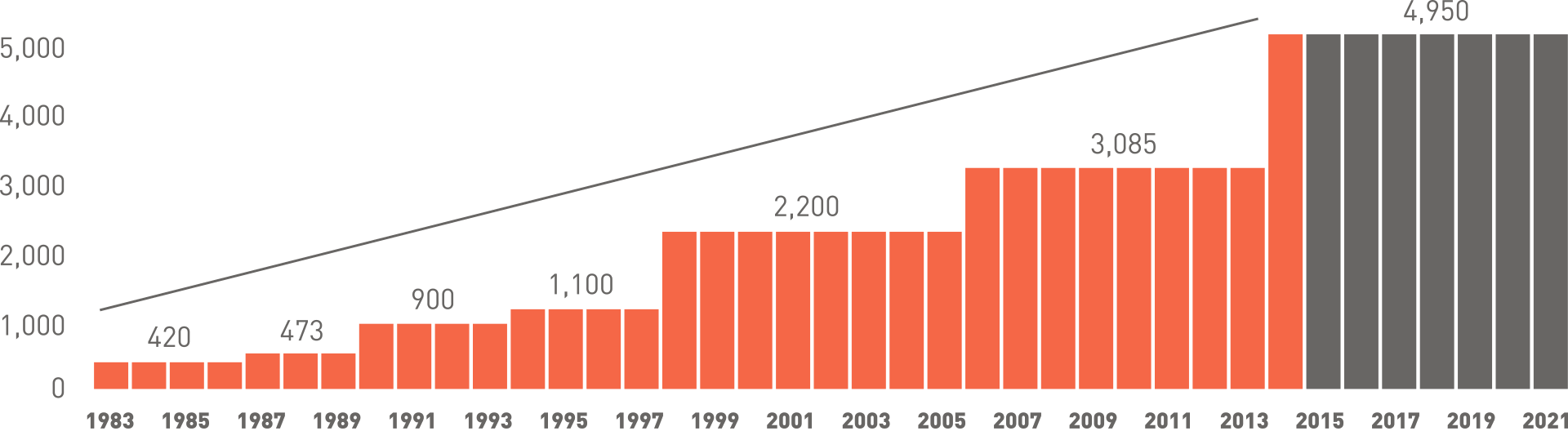

Broadcast rights have increased steadily in value through recent decades. But the formerly cozy and exclusive content rights agreements between leagues and broadcasters are now under siege by a number of forces: the explosion of over-the-top digital video providers, social networks, user-generated content, and mobile content apps. The NBA’s recent nine-year, $24 billion deal with Turner and ESPN will most likely be the last of the all-inclusive agreements. Other leagues, most notably Major League Baseball, have had success managing their own digital platforms. The NFL, which has maintained the most conservative content plan among pro sports leagues, recently gave Yahoo! the green light to livestream a Buffalo Bills-Jacksonville Jaguars game.

-

2014 year-over-year increase in sports video streams watched (Nielsen)

473%

We are entering a time of commercial and policy confusion for sports broadcast and advertising. There will be a proliferation of niche channels and digital sports media. The supplementation, augmentation, or replacement of broadcast sports is a generational time bomb.

Brett Hutchins

Author of

Sport Beyond Television: The Internet, Digital Media and the Rise of Networked Media Sports

For Sports Organizations

-

Maintaining exclusive dominion over regional viewership rights distinct from national and international contracts

-

Creating new business models designed for online viewers; developing mobile content

-

Integrating live sporting events with video games in real time

-

Using the Internet to build new fans for minor and emergent sports

For Broadcasters

-

Adopting a start-up mentality and becoming innovative leaders in online distribution of games and other sports media

-

Deciding whether to compete with or partner with new online venues and telecommunications providers

-

Preventing online piracy while responding to fans’ desire to share images, video and other content

-

Reacting to quickly-changing viewer habits and practices during a time of regulatory uncertainty in a fast-changing media environment

For Digital Media and Broadband Companies

-

Breaking the stranglehold that broadcasters hold over video content rights

-

Establishing profitable business models for the delivery of online sports content

-

Offering reliable premium content that will attract viewers

-

Developing profitable new apps in specialty mobile news and highlight packages

For Fans and Viewers

-

Finding high-quality, relevant sports news and information based on personal preferences in a media landscape with hundreds of options

-

Determining which sites, commentators, and sources can be trusted for accurate, timely, and reliable content

-

Deciding whether to pay for sports content or access it for free through sites that offer pirated or substandard media content

-

Becoming media sources themselves by offering other fans commentary, video, data, or other content

For over 40 years, sports leagues, franchises, and television networks enjoyed an unchallenged dominion over sports content. The roles were clear, the guarantees of exclusivity certain, and the profits reliable.

In December 1993, the NFL shocked the media when it granted the rights to NFC games to the upstart network Fox. The next major leap didn’t come until this June, when the NFL granted Yahoo! livestreaming rights to a Jacksonville Jaguars – Buffalo Bills game. The real sea change will happen when an Internet giant wins a multi-season contract.

Predicting the Future

-

1-5 Years

The Death of One-Size-Fits-All Broadcasting

-

Lulled into a sense of security by exclusive long-term rights contracts, broadcasters have been slow to innovate. Sporting events once offered free to national audiences have been increasingly moved behind paywalls (cable subscription or pay-per-view) in order to maintain profits. This creates a tension with a younger fan base that increasingly expects free and easy access to all forms of content online.

The floodgates to online access will finally open when a major online platform (likely Google) buys multi-year broadcast rights for a major sports league. At that point, traditional broadcasters will have to sprint to keep pace. Sporting events retain their immense value, but content becomes increasingly parsed and delivered in a multiplicity of ways to viewers using a variety of screens. The ongoing embrace of online delivery represents a Cambrian explosion of ways to access and to monetize sporting events.

-

5-10 Years

Divergence

-

Major networks become increasingly boxed out as leagues, franchises, players, and even fans themselves become popular content providers. Following the lead of Manchester United, sports franchises become their own media outlets, creating their own broadcast, radio, and online channels. Athletes increasingly step up to form their own media outlets. Derek Jeter’s The Players’ Tribune marks a critical advance toward this future. As one media observer noted: “Why would an athlete reveal news in an interview, when they can break news on their own media property?” Besides the networks, the biggest losers in this scenario are sports journalists, who increasingly become irrelevant as conduits of inside information.

Superfans take a seat at the table once exclusive to network commentators and sports journalists. Access to players through social media and other online formats is no longer the exclusive province of insiders. Superfans increasingly break national news stories by posting their own videos and encounters with players and owners. Viewers increasingly turn to these amateur announcers during games to hear in-depth, franchise-specific commentary that is not geared toward the average fan.

-

10-25 Years

The Convergence

-

The very word “broadcast” disappears from the popular lexicon. Fans will not only be accessing sports content from multiple places simultaneously, they will begin to integrate these streams into increasingly seamless, coherent, and personalized viewer experiences. These multi-layered viewing experiences may themselves be packaged and sold from fans to other fans. Depending on which friend’s house you visit to watch the game, your experience will be radically different.

You might watch an entire game through a virtual reality headset from the perspective of your favorite quarterback while your friend in another town watches the game from the point of view of a key offensive lineman of the other team. You share your comments and highlights in real time. Don’t like the outcome of a play? Simply click over to a multiplayer video game that can reset the exact conditions that you just watched and run the play your way.

Piracy and free online content pose a major risk to the value of broadcast rights.

In 2014 digital pirates generated over $220 million in ad revenue using stolen content as their lure to draw online viewers. No army of intellectual property rights lawyers will make this problem go away. The disruptive arrival of the Periscope personal livecasting app underscores the issue.

For the fan — particularly the younger fan — watching pirated content carries no stigma. More than 50% of Americans between the ages of 18 and 34 admitted to watching pirated content in a recent survey. (Even New England Patriots quarterback Tom Brady publicly admitted in 2012 to watching the Super Bowl on a pirate video service.)

The increasing cost of accessing exclusive content is the very thing that is driving the increase in piracy. “The popularity of piracy has definitely grown, and the awareness of it has definitely grown among the general public,” said Ricky Bruce, an analyst for NetNames, an anti-piracy company based in London. “Consumers are always going to find the cheapest way to consume content, especially if you’re going to have to pay for something that you previously had access to for free.”

Faced with these trends, broadcasters who are locked into rights contracts they bought for billions of dollars will have to scramble as they find that pay-per-view and cable consumers become a less reliable income stream.